Menu

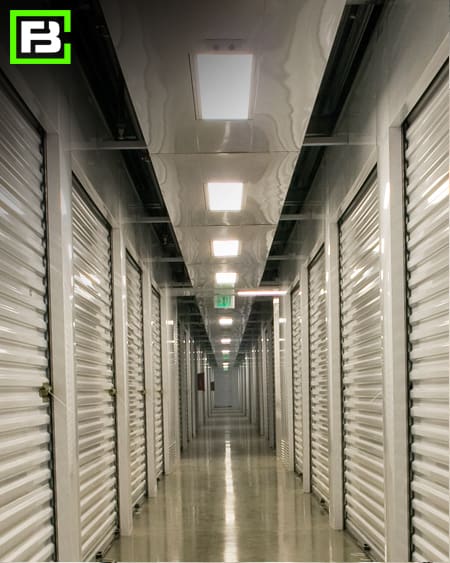

The self storage industry in the U.S. has experienced tremendous growth in the last several years. The current total square footage of self storage facilities in the U.S. is estimated at 2.35 billion square feet with the average facility size approaching 50,000 square feet. Due to their large size, unique space configuration, and recent technology changes, self storage facilities now have the opportunity to generate substantial Section 179D Energy Policy Act (EPAct) tax savings.1

The EPAct (Energy Policy Act) is a federal program allowing for a one-time tax deduction of up to $1.80/sq. foot. Buildings placed in service starting January 1, 2006 are eligible. New self storage construction projects are some of the best candidates for EPAct, usually qualifying for the full $1.80/sq. foot incentive.2

To qualify, you must incorporate energy-efficient construction or improvements that reduce the energy use of a building, specifically the lighting, building envelope, and mechanical systems.

You can take 179D deductions for new construction and retrofits, but you must be able to reduce total annual energy and power costs by 50 percent or more in comparison to the minimum requirements of ASHRAE Standard 90.1. If the 50% target savings is not met, the provision allows a partial deduction of $0.60 per square foot for each of the following components:

The following table illustrates the potential EPAct tax savings available to the self storage industry at and for an average size of 50,000 square feet

| Total Square Footage | Minimum Lighting Deduction | Maximum Lighting Deduction | HVAC Maximum Deduction | Building Envelope Maximum Deduction | Total Maximum Deduction |

|---|---|---|---|---|---|

| 50,000 sq.ft. | $15,000 | $30,000 | $30,000 | $30,000 | $90,000 |

| 2,350,000 sq.ft. | $705,000 | $1,410,000 | $1,410,000 | $1,410,000 | $4,230,000 |

Lighting

LightingIn the area of lighting, all self storage facilities upgrading to the highly energy efficient low wattage compact fluorescent lighting or LED (Light Emitting Diode) lighting would be eligible for a tax credit. It is also important for self storage facilities to use occupancy sensors or lighting control so that lights can be completely shut off for extended periods of time.

There is an increasing demand for climate controlled storage facilities since clients prefer facilities where it is more likely that their property and possessions will remain in good condition. Having a climate control option is a particularly important client attraction element since a mature self storage market has become more competitive. To maintain stored property properly, it is necessary to control temperature, humidity, and dust. Storage facilities are often ideal candidates for energy efficient energy recovery ventilation equipment (commonly called ERV), that optimizes the use of outside air. HVAC system designers who are familiar with storage centers can utilize high efficiency equipment and create a design configuration that optimizes the building spaces. HVAC design configurations that use less HVAC equipment to cover more rooms are much more likely to qualify for the EPAct HVAC tax deduction.

Self storage facilities in the northern U.S. states often use low-cost, energy-efficient natural gas heaters to meet their climate needs. Large tax deductions are often available for these heaters, provided that the self storage facility also upgrades to energy efficient lighting either before or currently with the heater purchase.

When self storage facilities are converted from an existing manufacturing warehouse or other facility, it is generally necessary to open the building envelope to insert access doors, overhead doors, and make other necessary self storage facility building envelope changes.

Since the building envelope doesn’t physically utilize energy, the ability to achieve a building envelope tax deduction is dependent on previous or concurrent investments in energy efficient lighting and HVAC systems. Here is an example:

A 200,000 square foot self storage facility invests $160,000 in energy efficient lighting and heating resulting in a 50% energy cost reduction. Although the building qualifies for a $360,000 EPAct tax deduction (200,000 sq.ft.* $1.80 per square foot), the initial EPAct tax deduction is limited to the $160,000 project cost. However, the remaining 200,000 of potentially available EPAct tax deduction can be used for building envelope improvements, such as new roof or insulation.

When it comes to accounting and taxes, self storage owners and investors should keep a few planning strategies and reporting considerations in mind to make the U.S. tax law work for them.

The key to maximizing self storage center EPAct tax deductions is to simultaneously install very energy efficient lighting with the other energy efficiency measures, particularly HVAC. The lighting upgrade is normally required since lighting is often the largest energy user in storage facilities, and the EPAct modeling tax system is based on total building energy cost reduction.

For example, installing energy efficient HVAC, such as dehumidification systems or natural gas heaters alone, may not enable a self storage facility to qualify for the HVAC EPAct tax deduction. However, installing energy efficient lighting with sensors, along with the upgrade to highly energy efficient HVAC, makes it much more likely that the HVAC will qualify for EPAct tax deduction.

Another tax consideration is depreciation. This refers to the amount an asset decreases in value over time. This reduction is due to wear and tear from typical use. In an accounting context, depreciation is estimated by considering the generally accepted useful life of an asset.

Here are some examples of specific items and their typical time for depreciation:

Residential building: 27.5 years

Residential building: 27.5 yearsAssets that depreciate over five to 15 years are generally eligible for something called “bonus depreciation,” which means you don’t have to write them off over their useful life. Thanks to the Tax Cuts and Jobs Act of 2017, you can take 100% bonus depreciation in the year you acquire the assets.4

Self storage operators can also benefit significantly from using cost segregation because of the unique types of construction and exterior improvements found on a storage site.

Cost segregation (also known as cost seg) is a federal tax methodology that uses modified accelerated cost-recovery systems (MACRS) to accelerate the timetable for property-depreciation deductions. To determine depreciation schedules, a cost seg study identifies and reclassifies personal property assets to shorten depreciation time.5

Under the MACRS methodology, you can identify and reclassify assets in five-, 15- and 39-year class lives, depending on the IRS determination of their actual useful life. Here are some examples:

By commissioning a cost segregation study, you can retain additional cash flow for capital improvements, repairs, or expansion. Self-storage operators can benefit significantly from using it because of the unique types of construction and exterior improvements found on a self storage site. And if your tax bill is lower, you can carry forward any unused depreciation amounts until they’re used up.

With the U.S. lifestyle changes due to more people working remotely, divorce, death, relocation, downsizing and more, self storage facilities have become a major building category in the U.S. Federal product law changes impacting existing technologies, and new energy-efficient retrofit products coupled with market competition provide a great opportunity to save energy costs and utilize the Section 179D EPAct tax incentives. This coupled with cost seg will have your business booming and more cash in your pocket.

When you are ready to build, convert, or expand your self storage facility, give the team at Forge a call. We will help you capitalize on making your facility energy efficient so that you can qualify for the maximum tax savings.

1 Energy Tax Savers, Inc. (n.d.). Retrieved from energytaxsavers.com: http://www.energytaxsavers.com/articles/Self-Storage-Facilities

2 Eric Ryan Corporation. (n.d.). Retrieved from ericryan.com: https://ericryan.com/dont-miss-the-epact-tax-deduction-opportunity/

3 Cost Segration Authority. (n.d.). Retrieved from costsegauthority.com: https://costsegauthority.com/section-179d/

4 Anderson, M. (2021, June 23). Inside Self-Storage. Retrieved from insideselfstorage.com: https://www.insideselfstorage.com/tax-issues/whats-your-plan-tax-considerations-todays-self-storage-operators

5 Engineered Tax Services. (2021, August 10). Retrieved from engineeredtaxservices.com: https://engineeredtaxservices.com/mobilize-upcoming-tax-changes-to-boost-your-cash-flow-use-cost-segregation-179d-tax-incentives-options-to-defer-taxes/

Note: Forge Building Company does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.